[Book summary] 7 Powers

Book summaries are helpful to decide whether to buy a book. Let's try them today for 7 Powers, a classic in Business Strategy.

The purpose of this summary is twofold:

For people who haven’t read 7 Powers, decide if you should. You can get it through this link.

For people who have already read 7 Powers, reflect back on the main learnings.

Disclaimer — 7 Powers is based on the foundational assumption that Strategy should focus on just one thing: potential business value through market share and margin.

Environmental and societal impacts are ignored. As a consequence, the Strategy view of the book is too narrowly focused in the mid-term. The author talks about long-term potential business value, but without sustainability, there’s no such thing.

You can not define long-term financials without taking into account the impact your business has on the rest of the world. If you don’t care about the other actors, you may decrease or even eliminate the market you are operating in.

If anyone knows of a great Strategy book that takes the company's impact on all stakeholders into account, including societal and environmental actors, please share it. Sadly, there’s too much Market Share and too little Market Size in 7 Powers.

Introduction

“Chance only favours the prepared mind.”

Good Strategy is simple but not simplistic.

Strategy — the study of the fundamental determinants of potential business value.

Strategy is split into ‘Statics’ i.e. “what makes a business good”, and ‘Dynamics’ i.e. “how to get there”.

Power — the set of conditions creating the potential for persistent differential returns.

A company strategy — a route to continuing Power in significant markets.

A company strategy is not about cleverness. Cleverness is for the execution.

Potential company value = current market size * discounted market growth factor * long-term market share * long-term differential margin = Market scale * Power

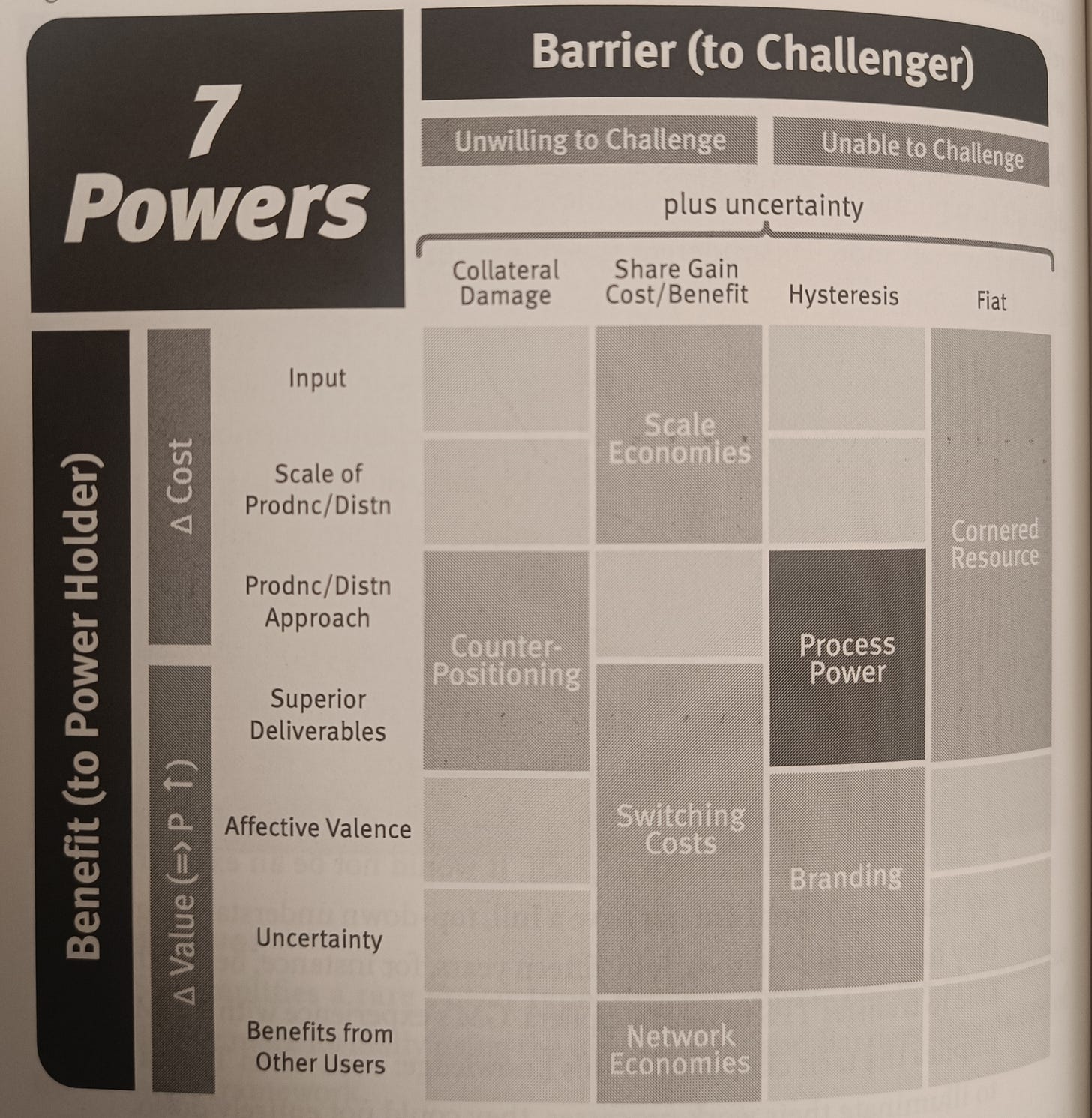

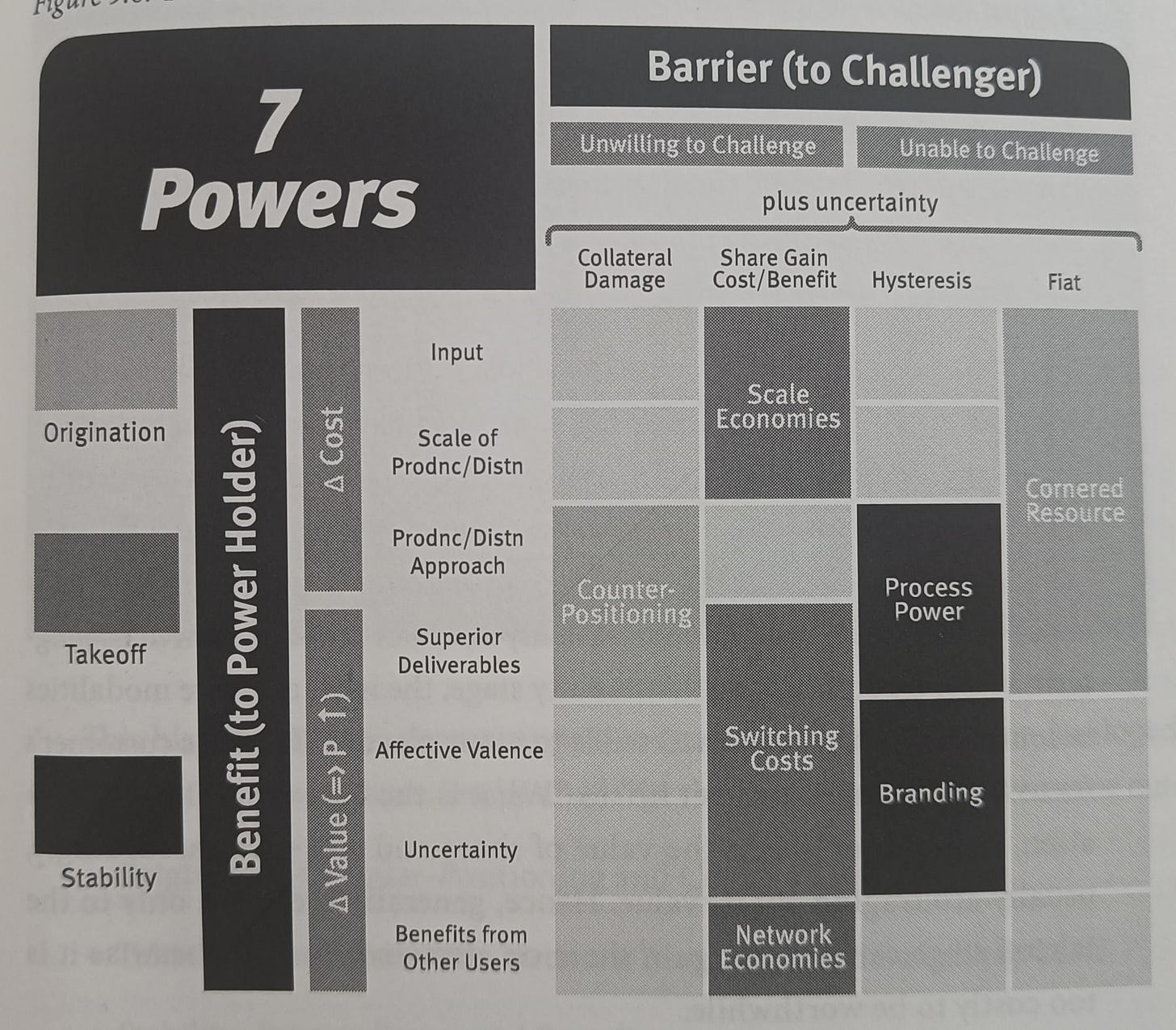

Power is split into Benefit and Barrier.

Benefit — the condition that brings cash flow augmentation.

Barrier — the condition that allows duration against competitors.

Power is your strength in relation to your competitors, so “always look at the barrier first.”

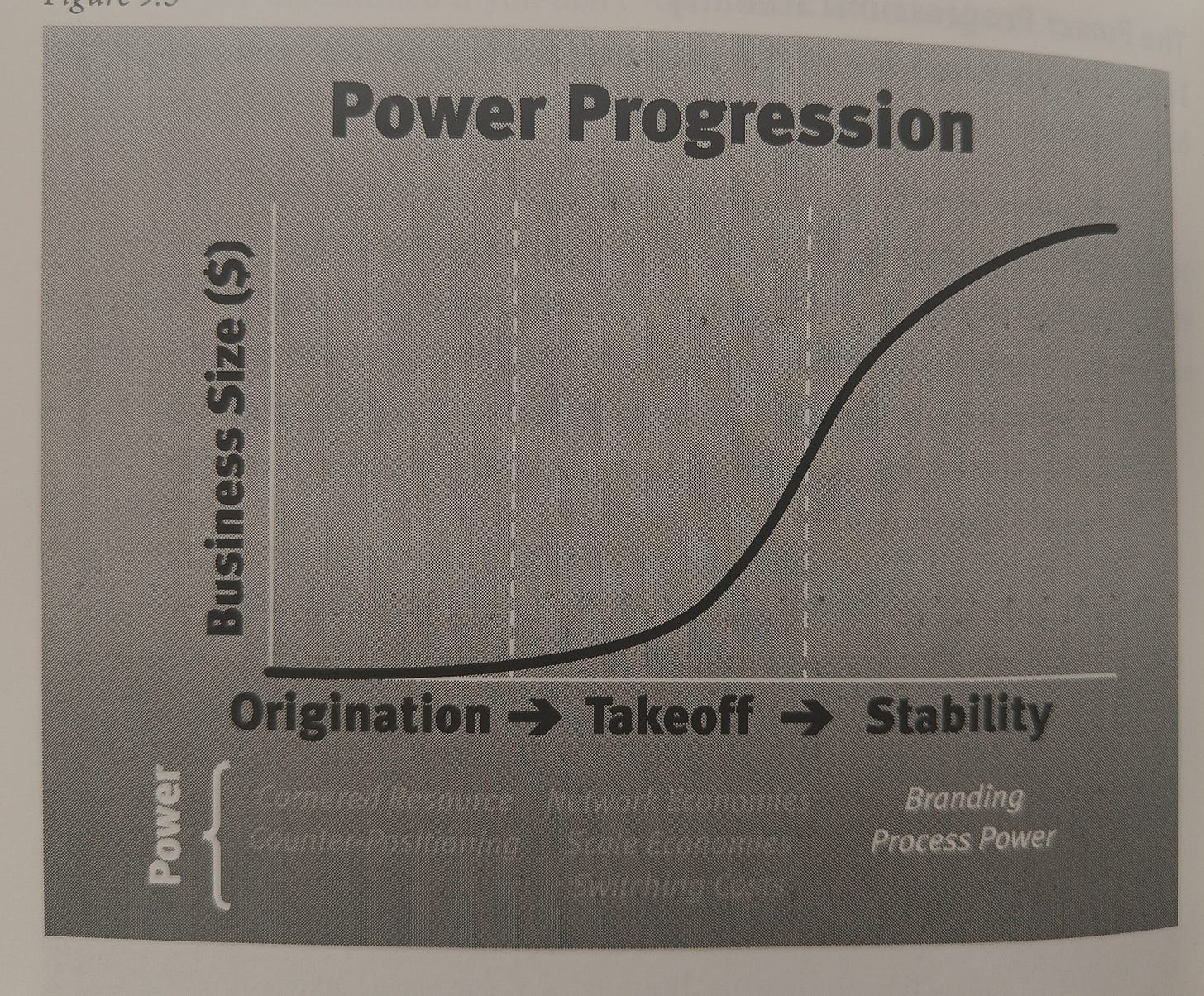

Ascent is not linear but a step function. Different powers can be unlocked at different stages.

Part 1. Strategy Statics

The first part of 7 Powers is about the Static 7 Powers that a company can obtain.

Chapter 1. Scale Economies

The Scale Economies Power — Leverage your market share to heavily reduce your variable costs.

The benefit of Scale Economies is obviously reduced variable cost.

The barrier created by Scale Economies is the prohibitive costs for smaller competitors to gain market share.

Example — Netflix’s Originals, the production cost of which is fixed and split across many subscribers.

Type 1 of Scale Economies — Volume/area relationship e.g. a warehouse.

Type 2 of Scale Economies — Distribution network density e.g. global companies vs local ones.

Type 3 of Scale Economies — Learning economies i.e. when more data helps reduce costs.

Type 4 of Scale Economies — Purchasing economies e.g. a large buyer purchasing for cheaper from their providers.

Power is potential for value. Value is then obtained through execution.

The Industry Economics of Scale Economies is their intensity.

The Competitive Position of Scale Economies is the relative scale of the company vs its competitors.

Chapter 2. Network Economies

The Network Economies Power — a business in which the value realized by a customer increases as the installed base increases.

The benefit of Network Economies is that companies can charge more due to offering higher quality e.g. LinkedIn having the biggest professional network.

The barrier created by Network Economies is unattractive cost/benefit for competitors to gain share because customers are stuck on the valuable high-scale products.

Network Economies produce winner-take-all situations.

Network Economies typically have clear boundaries on what they are used for e.g. Instagram vs LinkedIn.

The early stages of a product are decisive up to a critical mass e.g. Facebook could take over MySpace thanks to MySpace not being big enough yet.

Alex’s insight — Adaptability to new formats can break Network Economies e.g. Instagram (mobile-based) vs Facebook. Meta had tons of money for acquisitions, though. When you can’t beat them, buy them.

The Industry Economics of Network Economies is the intensity of the network effect.

The Competitive Position of Network Economies is the absolute difference in the installed base vs that of competitors.

Indirect network effects also play a role in Network Economies e.g. smartphone apps for smartphone OSs.

Chapter 3. Counter Positioning

The Counter Positioning Power — coming up with a new business model that breaks the existing one e.g. passive management vs active management.

In Counter Positioning, the newcomer adopts a new superior business model the incumbent does not mimic due to anticipated damage to their existing business.

The benefit of Counter Positioning is a better business model with lower costs and/or the ability to charge higher prices.

The barrier created by Counter Positioning is Collateral Damage. The incumbent is better off by staying on track with their existing business e.g. Active management companies couldn’t move to passive management without losing their business

The new play would also be attractive for the incumbent as a standalone proposal but following it would cannibalise their business.

Example — Kodak losing to digital cameras due to their business being film wasn’t counter positioning because film wasn’t an attractive business to them. They couldn’t win at it due to not having any defensible strategy for film.

Initially, there’s also uncertainty in the challenger approach so there’s high risk in following them.

The incumbent successful business model also adds a cognitive bias against changing it.

Incumbent CEOs’ incentives are typically in the short term. This doesn’t help.

In summary, there are three varieties of counter positioning: milk the existing business, cognitive bias and job security (of CEOs).

Power must be considered relative to each competitor. Counter-positioning only helps against the incumbent but not against other challengers.

Challengers can reinforce cognitive bias by being respectful towards the incumbent.

Alex’s insight — The challenger being respectful towards the incumbent sounds similar to OpenAI and Microsoft in B2B productivity.

The common 5 steps for incumbents are denial, ridicule, fear, anger and capitulation.

When incumbents decide to act, they typically try to maintain their previous business and end up losing it anyway.

Counter Positioning takes advantage of the strengths of the incumbent.

The industry economics of Counter Positioning are the new business model's superiority & the collateral damage to the existing one.

The competitive position of Counter Positioning is the new model vs the old model.

Incumbents can avoid Counter Positioning in specific markets e.g. it’s easier for Disney+ to play against Netflix in Europe but not the US where they have many existing deals with cable companies.

The incumbent finally goes into the new trend when they’ve lost so much that there’s no Counter Positioning happening anymore.

Chapter 4. Switching Costs.

The Switching Costs Power — The value loss expected by a customer incurred from switching to an alternate supplier for additional purchases.

Example — SAP has very low satisfaction but high retention.

The benefit of Switching Costs is charging more for follow-up products and/or recurring payments.

This benefit does not apply to new customers.

The barrier crated by Switching Costs is unattractive market share gains for the challenger.

Type 1 of Switching Costs —Financial Switching Costs i.e. the monetary costs.

Type 2 of Switching Costs — Procedural costs e.g. data and people process migrations.

Type 3 of Switching Costs — Relational costs of losing identity as a user, leaving communities and ending relationships with the product provider.

Alex’s insight — It would be interesting to analyse how much the Valve’s Steam vs Epic Games battle is a switching costs situation based on Relational costs.

The industry economics of Switching Costs is their magnitude.

The Competitive Position of Switching Costs is the number of current customers.

Chapter 5. Branding

The Branding Power — The durable attribution of higher value to an objectively identical offering that arises from historical information about the seller.

Alex’s insight — Is it historical info only for that company? The attention to detail around the packaging (or webpage) could flag a correlation with other brands in our brains. In other words, branding can be shared.

A customer pays a brand to not have to think about quality.

One benefit of Branding is Affective valence. Good feelings about the offering distinct from its objective value

Another benefit of Branding is uncertainty reduction thanks to trusting the brand.

The barrier created by Branding is the long period of reinforcing actions you need to build a brand.

Counter-example — Running an expensive ad when your company is already big is about leveraging Scale Economics, not Branding.

Brand dilution can happen when you move to a different geography or segment.

Example — Sony is not such a great brand for televisions in Japan as it is in the US and Europe.

Counterfeiting is a challenge to physical goods branding.

Changing consumer preferences can impact brands e.g. it’s challenging for Nintendo to adapt to children that have grown up while keeping their brand.

Branding is non-exclusive. Many companies can leverage it.

The type of goods leveraging Branding are typically consumer goods associated with a feeling of identity.

Products associated with bad tail events like food, transport and medicine also benefit greatly from Branding.

The industry economics of Branding is the magnitude of its effect.

The competitive position of Branding is the duration of creating a brand.

Branding significance is an S function, meaning that a lot of sustained effort is required before you start to see benefits

Chapter 6. Cornered Resource

The Cornered Resource Power — Preferential access at attractive terms to a coveted asset that can independently enhance value.

Example — Pixar’s Brain Trust (the group of leaders that brought amazing movies)

The benefit of a Cornered Resource is that no one else has it. I actually wrote a blog post earlier this year inspired by Pixar’s Ed Catmull’s Creative Inc.

Type 1 of Cornered Resource — Preferential access to valuable patent.

Type 2 of Cornered Resource — Minerals from nearby ground.

Type 3 of Cornered Resource — New manufacturing approaches unknown to competitors.

The barriers created by Cornered Resource are patent laws, proprietary rights, people not wanting to leave…

Cornered Resources are idiosyncratic: how does a company create something valuable again and again? The answer is typically a cornered resource.

Cornered Resources are non-arbitraged by the market and thus their value is much higher than their cost.

Cornered Resources are transferable.

Cornered Resources are necessary for the power to remain.

Cornered Resources are sufficient for potential success (differential returns). Otherwise, they are not a cornered resource

The industry economics of Cornered Resources is the price increment/cost reduction.

The competitive position of Cornered Resources is the preferred access to the resource at a non-arbitraging price.

There’s a clear Surplus Leader Magin = Margin increase due to CR - CR cost per sale.

Chapter 7. Process Power

The Process Power Power — Embedded company organization and activity sets which enable lower costs and/or superior products, and which can be matched only by an extended commitment.

Example — The Toyota Production System.

The benefit of Process Power is increased quality and reduced costs built up and then maintained over time.

The barrier crated by Process Power is that process advances can only be achieved over a long time period of sustained evolutionary advance.

The main reasons for the barrier to exist are complexity and opacity e.g. even at Toyota most of the system is tacit rather than explicit.

Process Power is operational excellence plus hysteresis.

Process Power occurs very rarely.

Unrelated to Process Power, it’s important to note that costs do ubiquitously decrease over time across most industries.

Alex’s thought — Why and for which industries does cost get constantly reduced? There’s an aspect of cost reduction due to improved physical or operational standards, sure, but there’s also worsened societal and environmental impact. This creates long-term debts.

Industry economics — Time constant and potential magnitude of Process Power effect

Competitive position — Relative duration of process power advances

Part II. Strategy Dynamics

The second part of 7 Powers shares insights on how to reach the Static 7 Powers.

Chapter 8. The Path to Power

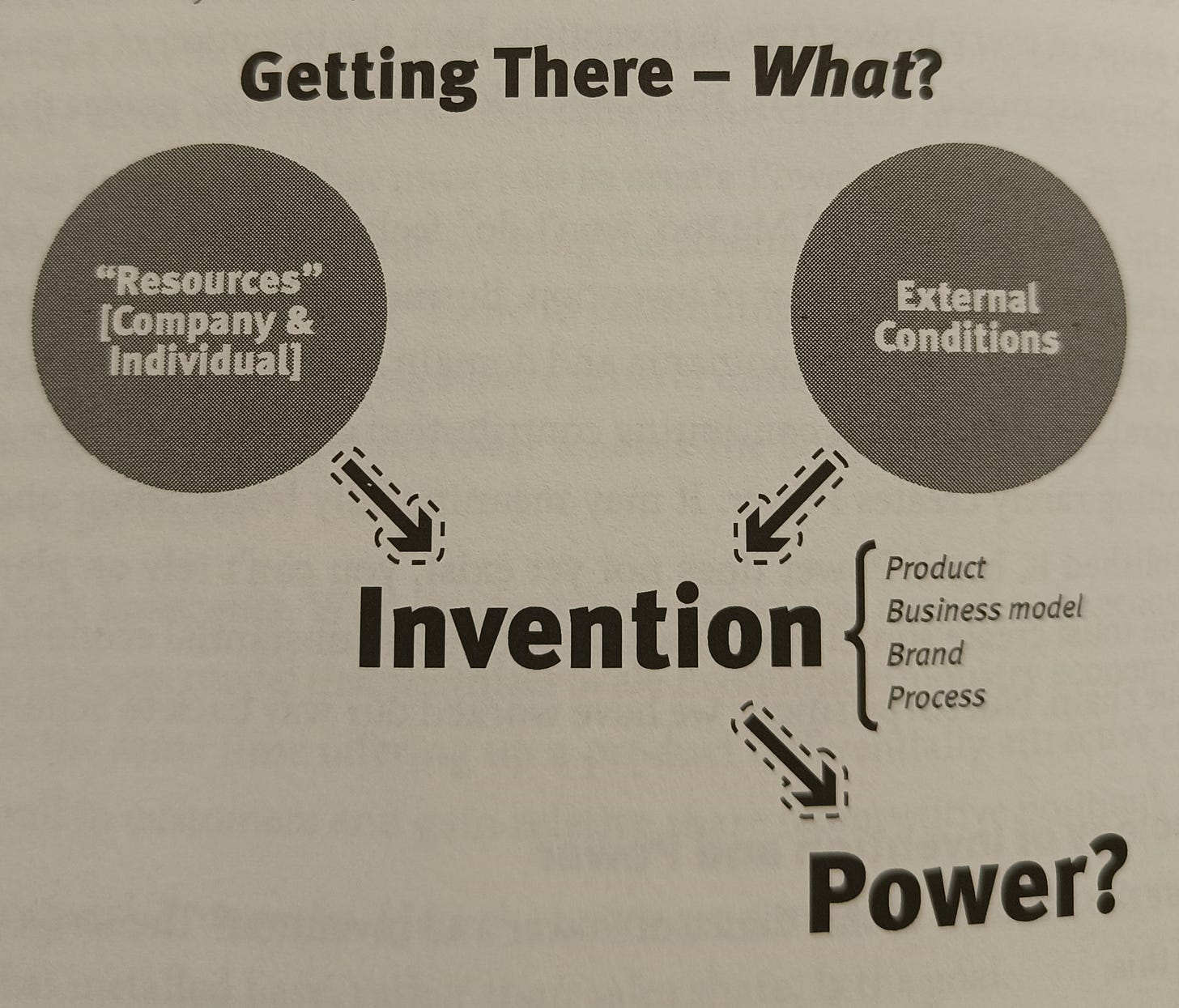

All Power starts with an invention.

The points below analyse the ascension to power of Netflix.

UIs are not enough to build power as they can be replicated.

Data to feed machine learning models has diminished returns over time. Accuracy can only get so high thanks to data.

Alex’s insight — That is true unless you pass the point of generalised understanding, as seen with LLMs (after 7 Powers was published).

IT infrastructure does not constitute power unless you are the main provider of the servers.

Alex’s insight — In hindsight, delegating video processing to AWS may have been a mistake for Netflix. A true differentiating factor could have been the unparalleled processing of video sold to other streaming companies.

Reminder: Netflix Originals was the success factor for Netflix.

Alex's insight — I guess Spotify is legally blocked from following a similar approach. They can always go all-in with GenAI virtual artists.

Dynamic processes bring Static Power. To assess which journeys are worth taking, you must first understand which destinations are attainable.

Example — To reach Scale Economies you need to offer an attractive product to gain a relative share.

Example — Network Economies also required attractiveness to gain installed (and usage) base, not share base.

Example — Cornered Resource is typically reached through patents.

Example — Branding requires consistent creative choices to foster affinity in the customer's mind.

Example — Counter Positioning is about pioneering a new, superior business model that promises collateral damage for incumbents when mimicked.

Example — Switching Costs is about a large customer base, like Scale Economies.

Example — Process Power is about evolving a complex inimitable process that yields an advantage over an extended period.

Action, creation and risk lie at the root of invention.

Passion and domain mastery fuel invention.

Planning can meaningfully boost Power once you have established it.

Flux in external conditions creates threats and opportunities for Power.

Companies willing to capitalise on a flux must invent (by crafting, not designing).

The company must find a route to power across the flux.

Example — Netflix moved to streaming as DVDs started to fall.

Resources are anything valuable you can bring to the table.

External conditions are market opportunities and limitations.

Invention must be crafted through trial and error.

Power is moving the invention towards a strategic power position.

Strategic thinking is powerful as a compass, not a map.

Success requires both Power and Scale of the market

Alex insight — Finally we talk about Market Size. Doesn’t the way you establish power influence the long-term market e.g. finite resources going away?

Inventions open up new solutions and also new markets, thus ensuring large-scale.

The value customers obtain will shape the market size.

You have to evoke a “gotta have” in customers.

Offer up a product that fulfils an unmet significant customer need.

Capabilities-led compelling value is building new tech without iteratively validating the need and hoping it works. Many times it takes years to work. Many times it doesn’t ever work before companies run out of money.

Example — Adobe Acrobat took 5 years to ramp up. It only did thanks to HTML becoming a standard but messing up with fixed formats.

Customer-led Compelling Value is about approaching well-known problems that no one has been able to solve yet.

Example — Long fibre optics were super hard to build and finally required a radical new approach to the one that had been previously invented for short fibres.

Competitor-Led Compelling Value is when the market exists but there’s potential to reshape it.

Example — Sony Playstation with its 3D-focused graphics chip sold 5x what the Nintendo 64 did and 10x what the Sega Saturn did.

Example — The iPhone breaking the phone market.

Competitor-led compelling value typically requires big investments upfront to ensure a good enough first version that can win over existing products.

Checking a company’s approach to the 7 Powers is a good tool for investment, especially in high-flux situations.

Chapter 9. The power progression.

This final power progression chapter is about when can you obtain Power.

Example — Intel landed IBM after Operation Crush and created Network Economies (more software available for common microprocessors), Scale Economies (design as fixed cost) and Switching Costs (out of the software).

Network Economies, Scale Economies and Switching Costs are established in the growth takeoff period (which finishes when growth is reduced to 30-40%).

When a company does not establish those powers at takeoff, competitive arbitrage will catch up as soon as growth slows.

Before takeoff, the Powers that can be established are Cornered Resource (the incumbents do not have it) and Counter-Positioning (the business model).

Branding and Process power are established after the takeoff.

Alex’s insight — I have some doubts about Branding. For some goods like clothes sold on social networks, Branding is there from the get-go / can be leveraged from the influencers’ Branding and their affinity to the new brand.

The hysteresis barriers are obviously about the time it takes (on the stability after take-off) to build or break the barriers.

The fiat barrier of the cornered resource is an underpriced asset that helps with takeoff.

The collateral damage barrier of Counter Positioning is the inability of others to adapt the business model.

The share gains cost/benefit barriers are determined by many factors during takeoff, but become standardised at the stability stage due to commoditization.

A note on operational excellence: it’s not a power per se but it’s necessary to attain and leverage Power.

Recap of the book — Strategy is a real-time compass to find continuing Power in significant markets.

Alex's insight — Sure, but it’s not a way to sustain markets.

You should have or attain at least one of the 7 Powers against each of your competitors.

It’s worth discussing power ex-ante, at an early stage. Even if the strategy needs to be crafted, the discussions around power provide a compass.

That’s the last bullet point. Thanks for reading! Sharing the link to get 7 Powers again in case you’d like to read it. Please consider subscribing if you liked this post.